20+ ky payroll calculator

To calculate an annual salary multiply the gross pay before tax. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

Kentucky Paycheck Calculator Tax Year 2022

For example if an employee earns 1500 per week the individuals annual.

. The GrossUp paycheck calculator. Well do the math for youall you need to do is enter. Kentucky Kentucky Salary Paycheck Calculator Change state Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky. Federal Paycheck Calculator Calculate your take home pay after federal state local taxes Updated for 2022 tax year on Aug 02 2022. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky.

Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. The bonus calculator aggregate method The bonus calculator percentage method The 401k payroll calculator.

AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA. Simply enter their federal and state W-4 information as. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries.

Supports hourly salary income and multiple pay frequencies. Kentucky Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Employers can use it to calculate net pay and figure out how.

The process is simple. This free easy to use payroll calculator will calculate your take home pay. Examples of payment frequencies include biweekly semi-monthly or monthly.

To estimate a paycheck begin with the total annual salary amount in addition to divide by the particular quantity of pay durations in the year. Payroll Payroll Fast easy accurate payroll and tax so you can save. The hourly paycheck calculator.

All you have to do is enter each employees wage and W-4 information and.

How To Calculate Payroll Taxes Wrapbook

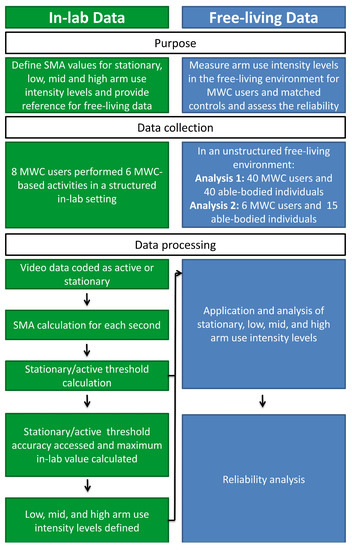

Sensors Free Full Text Application And Reliability Of Accelerometer Based Arm Use Intensities In The Free Living Environment For Manual Wheelchair Users And Able Bodied Individuals Html

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Application Of An Equine Composite Pain Scale And Its Association With Plasma Adrenocorticotropic Hormone Concentrations And Serum Cortisol Concentrations In Horses With Colic Lawson 2020 Equine Veterinary Education Wiley Online Library

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Medreps Salary Calculator Medical Sales Careers

Kentucky Paycheck Calculator Smartasset

250 Wages Administration Stock Photos Free Royalty Free Stock Photos From Dreamstime

Frbmfhxcdzpxym

How To Calculate Severance Pay 7 Steps With Pictures Wikihow

Medreps Salary Calculator Medical Sales Careers

Does A Speeding Ticket Affect Your Insurance Insurance Com

250 Wages Administration Stock Photos Free Royalty Free Stock Photos From Dreamstime

![]()

Data Management How To Keep Your Payroll Information Hush Hush Finance Derivative

250 Wages Administration Stock Photos Free Royalty Free Stock Photos From Dreamstime

Kentucky Paycheck Calculator Tax Year 2022

If Your Ctc Is Rs 40 Lpa What Do You Take Home After Taxes And Other Deductions Quora